January 2023

臺灣行政院通過「證券交易稅條例」部分條文修正草案

2023.01

陳信宏、施志寬

行政院為促進權證市場發展,於2022年12月8日通過「證券交易稅條例」(下稱「本條例」)部分條文修正草案(下稱「草案」),並送請立法院審議。草案之重點在於:認購(售)權證發行人調節避險專戶內之特定股票適用優惠稅率為千分之一。

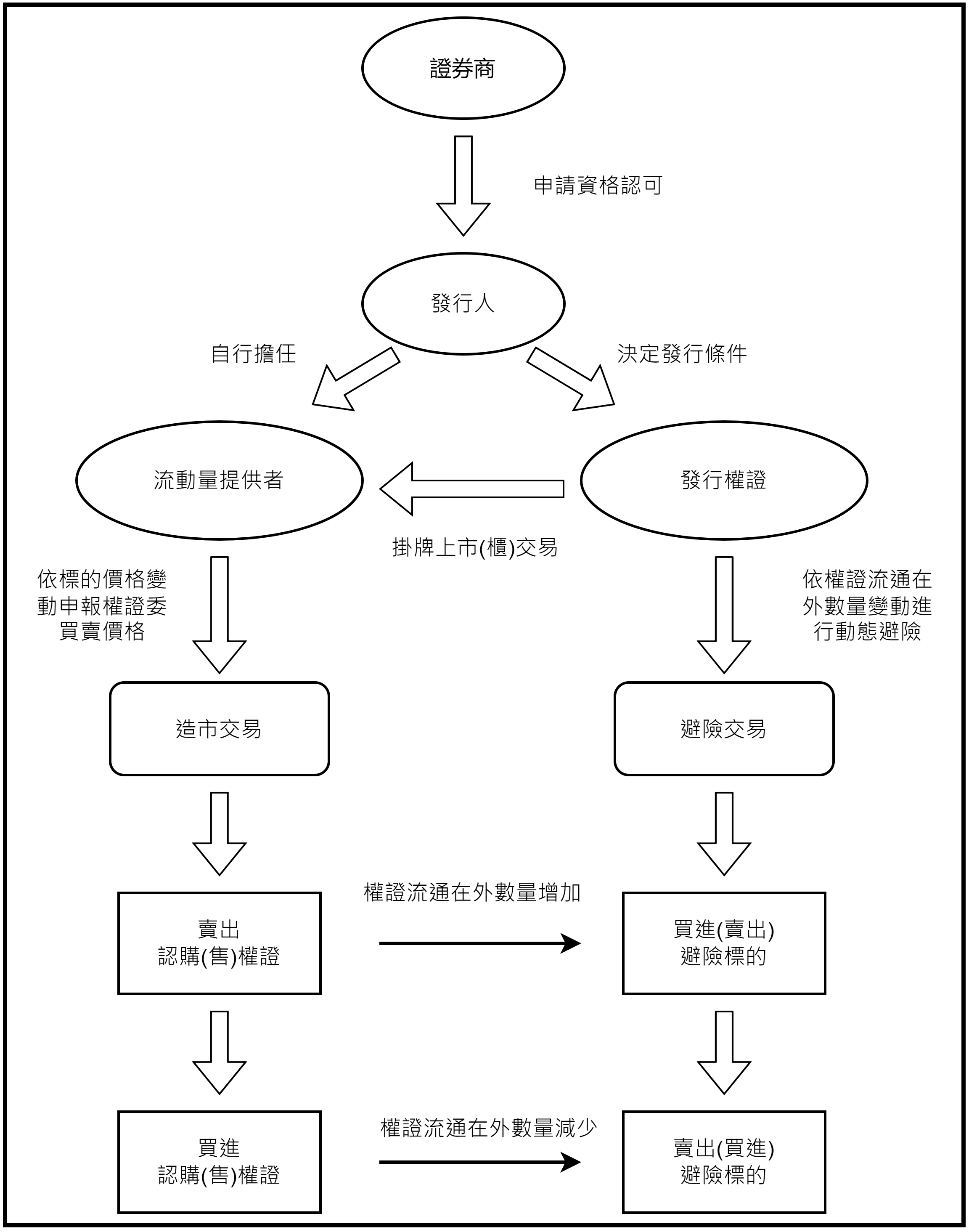

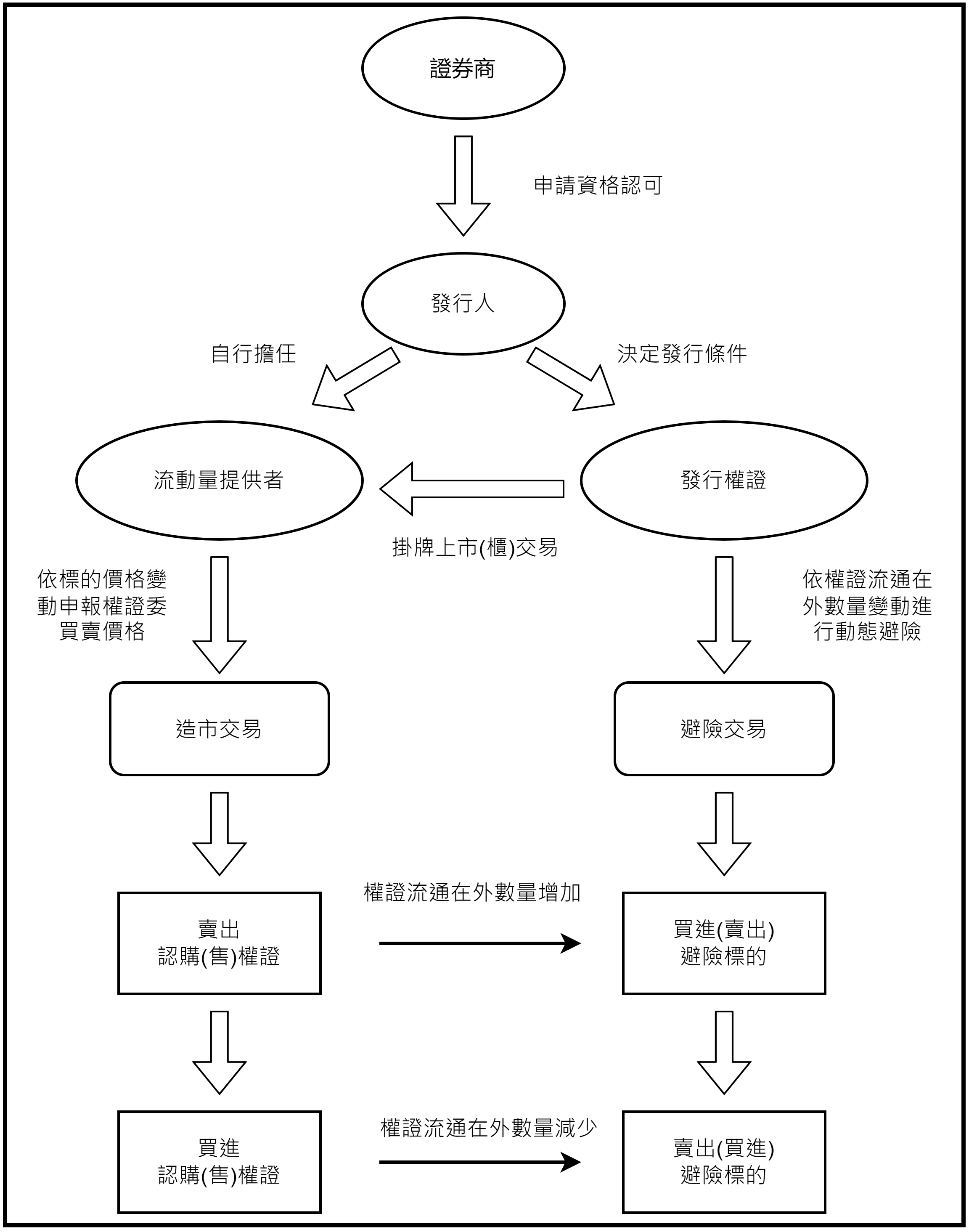

現行證券交易稅之稅率原則為千分之三,例外於現股當日沖銷交易為千分之一點五(本條例第2條第1款、第2條之2)。另依臺灣證券交易所股份有限公司及財團法人中華民國證券櫃檯買賣中心之相關規定,權證發行人應有流動量提供機制,並履行報價責任,如下圖[1]所示:

為降低權證發行人建立及調節避險部位之成本,提升報價品質,草案增訂認購(售)權證上市(櫃)日至到期日期間,基於履行報價責任規定及風險管理目的,自草案生效日起五年內,出賣認購(售)權證避險專戶內經目的事業主管機關核可之標的股票者,其每日交易成交總金額在避險必要範圍內之部分,按每次交易成交價格依千分之一稅率課徵證券交易稅(草案第2條之3),並應依規定期限將權證避險專戶之交易明細列具清單報告於稽徵機關(草案第3條第4項)。

但權證持有人按約定行使價格向權證發行人購入標的股票者,與一般股票交易並無不同,仍按前開現行所訂稅率課徵證券交易稅。

政府預期草案通過後有助於健全權證交易制度,可活絡權證交易市場,且因此反可增加相關稅收,故後續立法進程值得持續追蹤。

[1] https://www.fsc.gov.tw/fckdowndoc?file=/%E5%B0%88%E9%A1%8C%E4%B8%8031-10(1).pdf&flag=doc

陳信宏、施志寬

行政院為促進權證市場發展,於2022年12月8日通過「證券交易稅條例」(下稱「本條例」)部分條文修正草案(下稱「草案」),並送請立法院審議。草案之重點在於:認購(售)權證發行人調節避險專戶內之特定股票適用優惠稅率為千分之一。

現行證券交易稅之稅率原則為千分之三,例外於現股當日沖銷交易為千分之一點五(本條例第2條第1款、第2條之2)。另依臺灣證券交易所股份有限公司及財團法人中華民國證券櫃檯買賣中心之相關規定,權證發行人應有流動量提供機制,並履行報價責任,如下圖[1]所示:

為降低權證發行人建立及調節避險部位之成本,提升報價品質,草案增訂認購(售)權證上市(櫃)日至到期日期間,基於履行報價責任規定及風險管理目的,自草案生效日起五年內,出賣認購(售)權證避險專戶內經目的事業主管機關核可之標的股票者,其每日交易成交總金額在避險必要範圍內之部分,按每次交易成交價格依千分之一稅率課徵證券交易稅(草案第2條之3),並應依規定期限將權證避險專戶之交易明細列具清單報告於稽徵機關(草案第3條第4項)。

但權證持有人按約定行使價格向權證發行人購入標的股票者,與一般股票交易並無不同,仍按前開現行所訂稅率課徵證券交易稅。

政府預期草案通過後有助於健全權證交易制度,可活絡權證交易市場,且因此反可增加相關稅收,故後續立法進程值得持續追蹤。

[1] https://www.fsc.gov.tw/fckdowndoc?file=/%E5%B0%88%E9%A1%8C%E4%B8%8031-10(1).pdf&flag=doc